The Best Strategy To Use For Clark Wealth Partners

Not known Incorrect Statements About Clark Wealth Partners

Table of ContentsSome Known Details About Clark Wealth Partners 10 Easy Facts About Clark Wealth Partners ShownWhat Does Clark Wealth Partners Mean?Clark Wealth Partners Can Be Fun For AnyoneThe 6-Minute Rule for Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.5 Easy Facts About Clark Wealth Partners ShownThe 10-Minute Rule for Clark Wealth Partners

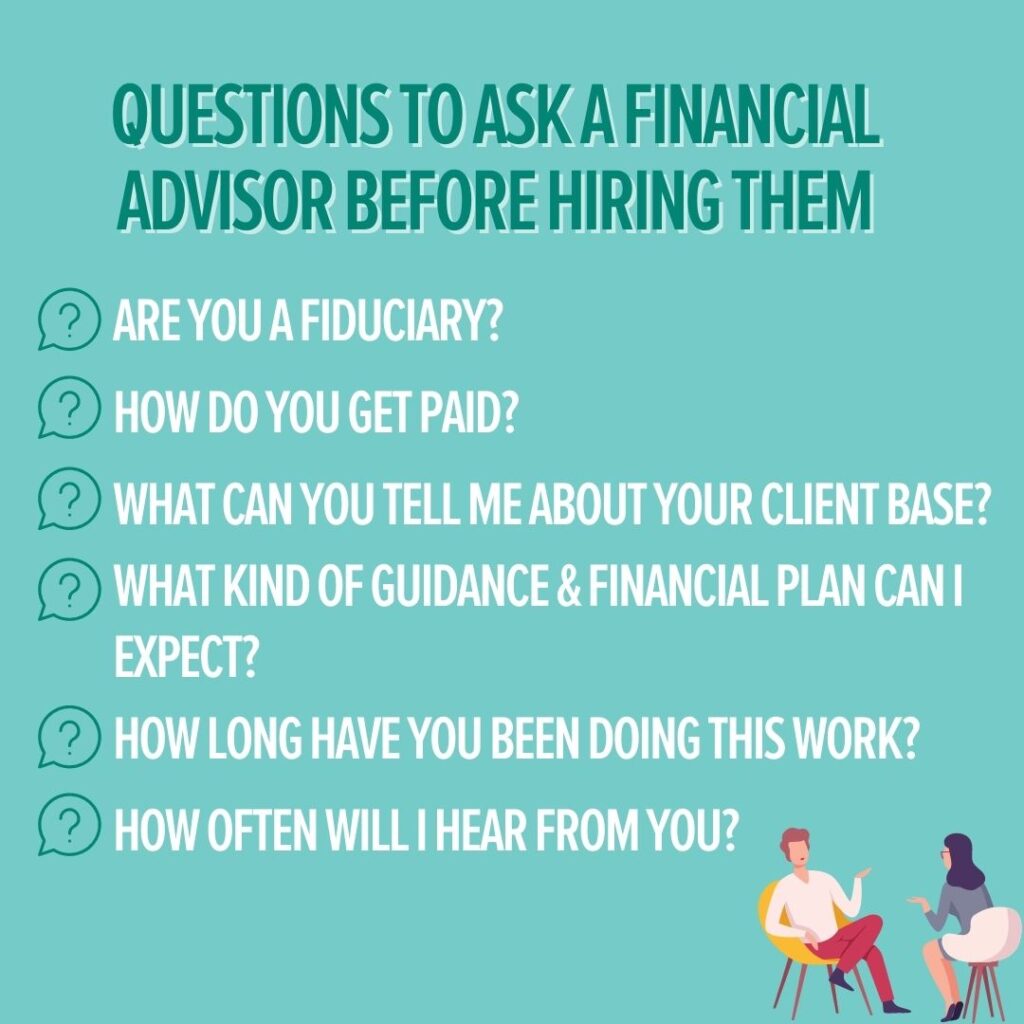

Usual factors to take into consideration a monetary expert are: If your economic scenario has actually come to be a lot more intricate, or you lack confidence in your money-managing abilities. Conserving or browsing major life events like marriage, divorce, kids, inheritance, or job change that may dramatically influence your financial situation. Browsing the shift from saving for retirement to maintaining wide range throughout retired life and how to create a strong retirement income plan.New technology has actually brought about more extensive automated economic devices, like robo-advisors. It's up to you to explore and determine the right fit - https://clrkwlthprtnr.wordpress.com/2025/11/26/why-choosing-the-right-financial-advisors-illinois-matters-for-your-financial-future/. Eventually, a good monetary consultant should be as conscious of your investments as they are with their very own, staying clear of too much charges, saving cash on tax obligations, and being as transparent as possible regarding your gains and losses

Excitement About Clark Wealth Partners

Earning a commission on product suggestions doesn't always imply your fee-based advisor works against your benefits. However they may be more likely to recommend product or services on which they earn a payment, which may or may not remain in your benefit. A fiduciary is lawfully bound to put their client's rate of interests first.

This typical permits them to make referrals for investments and solutions as long as they fit their client's objectives, threat resistance, and economic circumstance. On the other hand, fiduciary consultants are lawfully bound to act in their customer's best rate of interest rather than their very own.

Top Guidelines Of Clark Wealth Partners

ExperienceTessa reported on all things spending deep-diving into complicated financial topics, shedding light on lesser-known financial investment opportunities, and uncovering methods viewers can function the system to their benefit. As an individual money professional in her 20s, Tessa is acutely familiar with the impacts time and unpredictability carry your investment decisions.

It was a targeted advertisement, and it worked. Review extra Review less.

Some Known Questions About Clark Wealth Partners.

There's no solitary path to ending up being one, with some individuals starting in financial or insurance, while others start in bookkeeping. 1Most financial coordinators begin with a bachelor's level in financing, business economics, accountancy, business, or a related subject. A four-year degree supplies a strong structure for jobs in investments, budgeting, and client services.

The Facts About Clark Wealth Partners Uncovered

Common examples consist of the FINRA Collection 7 and Series 65 examinations for protections, or a state-issued insurance coverage permit for offering life or medical insurance. While credentials might not be lawfully needed for all preparing duties, companies and customers often watch them as a criteria of expertise. We consider optional credentials in the next section.

The majority of financial coordinators have 1-3 years of experience and familiarity with financial items, conformity requirements, and direct client interaction. A strong academic history is necessary, however experience demonstrates the capability to apply theory in real-world settings. Some programs incorporate both, permitting you to finish coursework while earning monitored hours with internships and practicums.

Rumored Buzz on Clark Wealth Partners

Many enter the field after operating in financial, accounting, or insurance, and the change needs determination, networking, and commonly advanced credentials. Early years can bring long hours, stress to build a customer base, and the requirement to constantly prove your competence. Still, the occupation offers solid lasting capacity. Financial coordinators take pleasure in the chance to work carefully with clients, overview essential life decisions, and often attain adaptability in schedules or self-employment.

They invested much less time on the client-facing side of the market. Virtually all monetary managers hold a bachelor's degree, and many have an MBA or similar graduate degree.

The Ultimate Guide To Clark Wealth Partners

Optional accreditations, such as the CFP, commonly call for additional coursework and screening, which can extend the timeline by a number of years. According to the Bureau of Labor Data, individual monetary experts gain a typical annual yearly salary of $102,140, with top income earners gaining over $239,000.

In various other districts, there are guidelines that need them to meet specific needs to use the economic expert or monetary coordinator titles (st louis wealth management firms). What sets some economic experts apart from others are education, training, experience and qualifications. There are many classifications for financial advisors. For monetary coordinators, there are 3 usual designations: Certified, Individual and Registered Financial Organizer.

A Biased View of Clark Wealth Partners

Where to locate a monetary advisor will Read More Here certainly depend on the type of recommendations you require. These organizations have personnel that may assist you comprehend and purchase particular types of financial investments.